The TAH Foundation and Hiilivapaa Suomi organized a roundtable discussion at Puistokatu 4, bringing together Finnish institutional investors to discuss global emission reductions in the steel sector.

Traditionally, the steel industry has been considered a particularly challenging and slow sector for emission reduction. However, with the emergence of low-carbon innovations, growing demand for them, and the increased engagement activities of investors, progressive steel players are gradually standing out.

The crucial role of investors was strongly emphasized in the event organized by the TAH Foundation and Hiilivapaa Suomi (“Carbon-Free Finland”) last week at Puistokatu 4, Helsinki. The invitation-only event brought together significant players in the finance sector to discuss how investors holding steel companies in their investment portfolios can participate in emission reduction efforts within the steel sector while ensuring the profitability of their investments in the future.

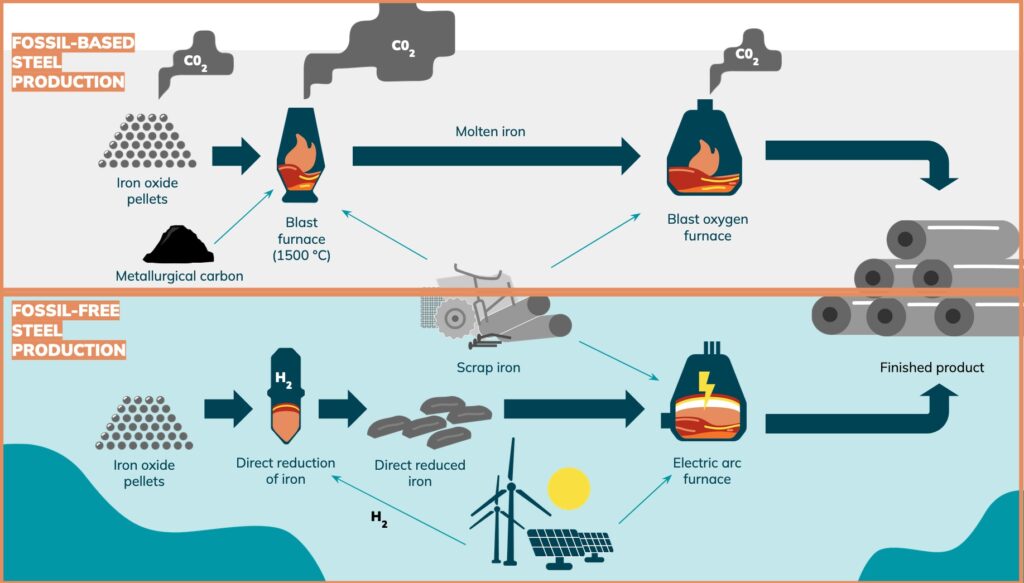

Cleaner technology is already available and ready for use

Speakers at the event, Professor Timo Fabritius from the Process Metallurgy Research Unit at the University of Oulu, and Harri Lammi, Head of Environmental Projects at the TAH Foundation, discussed the technological prerequisites for producing cleaner steel and the readiness of the steel sector for the transition.

According to Fabritius, key technological solutions include direct reduction of iron ore with hydrogen, steel recycling, and electric arc furnaces. These technologies address carbon emissions in the steel industry, originating from outdated blast furnace technology reliant on coal. In adopting new technologies, European countries and the United States have excelled, while in the world’s leading steel-producing countries such as China and India, investments are still directed toward traditional methods.

Steel companies pay close attention to investors

Victoria Lidén, Senior Sustainability Analyst at Norwegian asset management Storebrand, emphasized the recent engagement activities of investors as global steel giants make investment decisions for factory upgrades that extend decades into the future. Relying on blast furnace technology locks a steel company into a carbon-intensive path for years to come, posing a significant investment risk.

Lidén provided an example of how closely steel companies listen to the voices of shareholders. In the spring of 2022, Storebrand engaged in intensive dialogue with one of the top polluters in its investment portfolio, Japan’s second-largest steel company, JFE. Only a few months later, JFE strengthened its climate commitments and eventually announced a plan to replace a blast furnace with clean electric arc technology.

A key success factor was building dialogue with the support of other investors such as Man Group and the investor advocacy organization ACCR. “Timing and collaboration and willingness to escalate, if necessary, are key to achieving effective dialogue. It is easier to succeed by joining forces with other investors,” summarized Lidén.

Panel seeked ways for investor engagement

In the panel discussion that concluded the official part of the event, institutional investors explored opportunities to influence steel emission reductions and ensure the preservation of shareholder value during the transition in the coming decades. The panel included Lidén, Martin Norman, Director of Investor Engagement at ACCR, and Bernt Nordman, Director of Climate Program at WWF Finland.

If your investments are in outdated technologies, you are risking shareholder value in the long term.

An investor does not need to have a large stake in a company to be heard in negotiations with companies. “The most important thing is to be present in the negotiating room with the strength of one’s name and assets under management,” summarized ACCR’s Norman.

Bernt Nordman also emphasized the importance of coalitions. “In creating pressure and reaching politicians, NGOs can assist,” Nordman said.

But can investors really influence emissions reduction, and why should one believe in it?

According to Martin Norman, there is no alternative. “If your investments are in outdated technologies, you are risking shareholder value in the long term.”

TAH Foundation funds project partners pushing forward steel transition

The TAH Foundation funds several actors who participated in the event, such as steel influence by Hiilivapaa Suomi, steel research by the University of Oulu, Science-Based Targets initiative coordination by WWF Finland, and ACCR specializing in global investor advocacy on steel production. You can find more information about the projects funded by our foundation here.

Harri Lammi, Head of Environmental Projects at our foundation, summarizes the importance of investor work for steel decarbonization:

“Global steel production is facing significant change. Private steel companies and their investments in low-emission technologies are now driving change internationally. Investors who own steel companies have a significant impact on the strategies and the speed at which steel companies undertake emission reductions.”